What is IFRS for SME’s?

-Anneke Fourie.

On 9 July 2009, the International Accounting Standards Board (IASB) issued the IFRS for SMEs. This is the first set of international accounting requirements developed specifically for small and medium-sized entities (SMEs). It has been prepared on IFRS foundations, but is a stand-alone product that is separate from the full set of International Financial Reporting Standards (IFRSs). The IFRS for SMEs has simplifications that reflect the needs of users of SMEs' financial statements and cost-benefit considerations.

Compared with full IFRSs, it is less complex in several ways:

Topics not relevant to SMEs are omitted.

Where full IFRSs allow accounting policy choices, the IFRS for SMEs allows only the easier option.

Many of the principles for recognising and measuring assets, liabilities, income and expenses in full IFRSs are simplified.

Significantly fewer disclosures are required.

The standards have been written in clear, easily translatable language.

Who can use the IFRS for SME’s?

The term ‘small and medium-sized entities’ has different meanings in different territories or countries. The definition in the context of the IFRS for SMEs is:

entities that do not have public accountability and

publish general purpose financial statements.

Every entity has some form of accountability, if only to its shareholders and to SARS. Public accountability is defined to cover entities with or seeking to have securities traded in a public market or that hold assets in a fiduciary capacity as their main business activity. (Most banks, credit unions, insurance companies, securities brokers/dealers, mutual funds and investment banks would meet this second criterion). The definition is therefore based on the nature of an entity rather than on its size.

SMEs are estimated to represent well over 95 per cent of all companies in both developed and developing countries. The majority of financial statements in South Africa are compiled by implementing the IFRS for SMEs as a financial reporting framework.

Where a transaction is not addressed by the IFRS for SMEs, management is expected to use judgement to determine its accounting policy. If such a transaction is covered in full IFRS, management may refer to the appropriate international standard if it wishes but is not required to do so by the IFRS for SMEs.

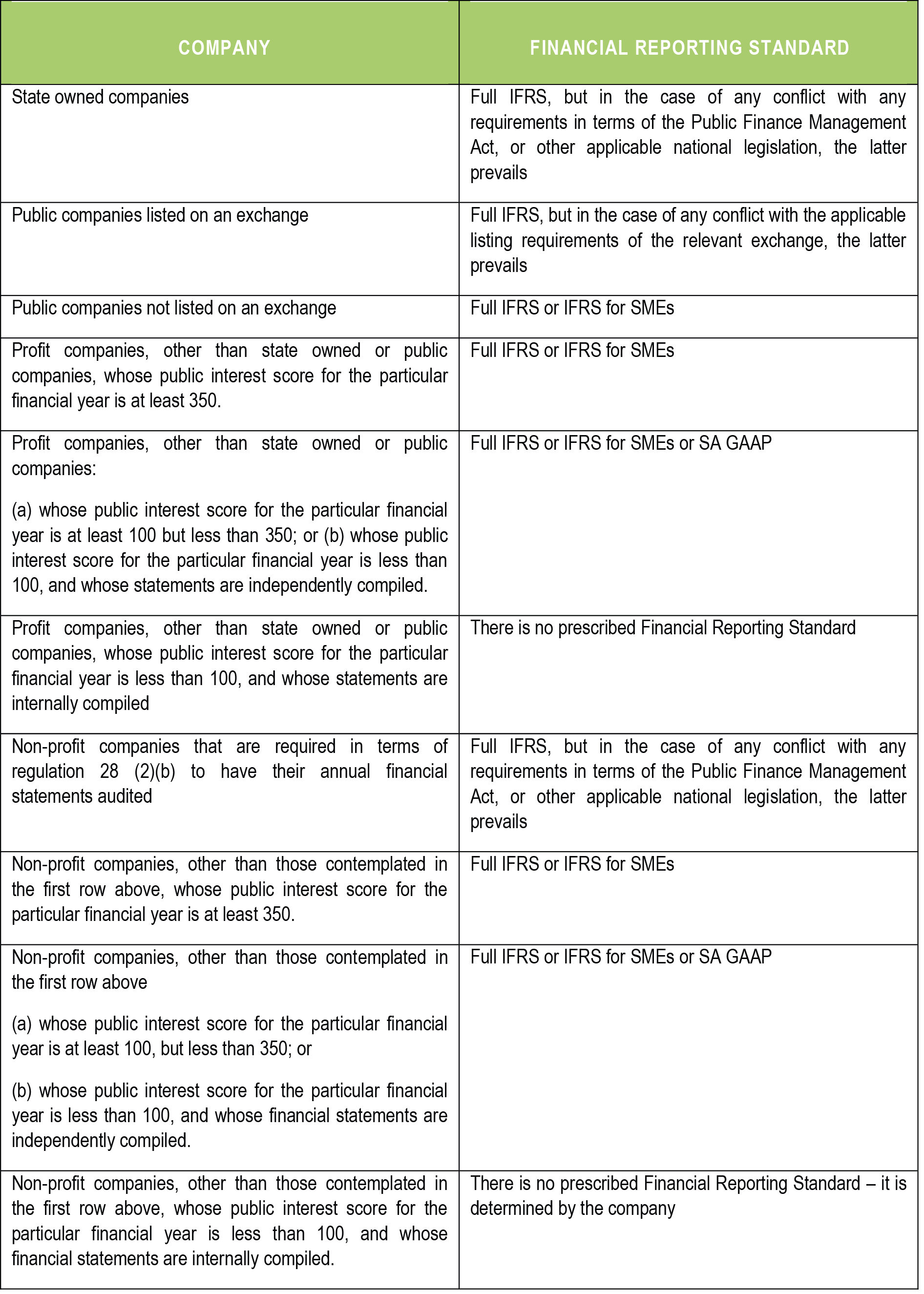

South African Companies Act and IFRS

Both IFRS and the IFRS for SMEs are permitted.

All entities apart from public companies, state-owned companies and certain non-profit companies are allowed to apply the IFRS for SMEs.

Can a trust apply the IFRS for SMEs?

There is no legal requirement for a trust to prepare financial statements. There might however be an obligation to prepare financial statements in the trust deed.

Trusts are governed by the Trust Property Control Act and trustees should be wary of adding additional unnecessary requirements to the trust deed.

It would however be advised that trusts keep proper record of the trust assets whether in Excel or a simple accounting program.

Interestingly, all trusts are required by the Master to appoint an auditor/accountant despite there being no such requirement in the Trust Property Control Act.

Published: 02 August 2021